Tester’s bill, the Economic Growth, Regulatory Relief, and Consumer Protection Act, aims to increase access to capital by cutting red tape for community banks and credit unions, while protecting consumers against risky Wall Street bets. Tester took to the Senate floor today (watch video) to underscore the urgent need to provide community banks and credit unions with regulatory relief to prevent further bank consolidation in Montana.

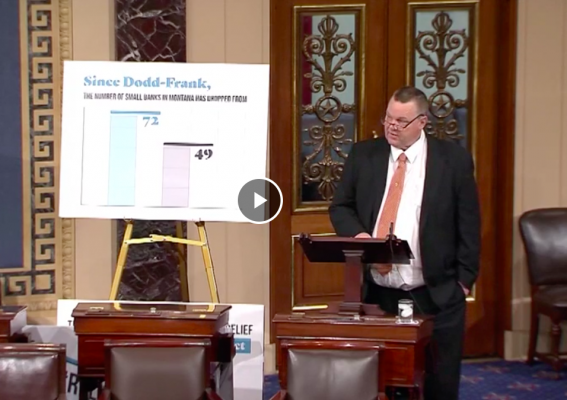

According to Tester’s office, Montana has lost 23 chartered banks since 2008: “Many of these banks have consolidated and closed down as a result of the costs related to complying with regulations that were targeted to reign in the behavior of the nation’s largest financial institutions.”

An Associated Press fact check of Montana banking statistics was carried in the Bozeman Daily Chronicle.

or Download